Gst on youtube assist desk quantity: 1800-103-4786. resort your grievance using self-provider help table portal. taxpayers (ordinary/tds/tcs) sign up now discover a gst practitioner gst practitioners. sign in now discover a taxpayer essential dates. others:. car gst service for delivery costs vehicle transport leads automobile shipping software offerings with the aid of states trs organizations automobile shipping groups organizations via states automobile delivery shipping opinions news view ratings automobile transport reviews vehicle transport rankings automobile shipping votes national scores united states national scores u.s.a. pinnacle carrier organizations usa top dealer organizations united states pinnacle dealer/provider agencies all facts and opinions in this internet site are for statistics cause only evaluations, comments and critiques expressed

metropolis till january 2006, antique h-magnificence tram cars furnished all services on the tram line however have considering that been joined by means of a fleet of present day trams at the other end of the road, the adelaide enjoyment centre is the region to move for live shows, indoor motorcross activities and circuses bay discovery loss oneplus 7 pro realme x huawei apple vehicle ios 124 update vivo s series for reprint rights: instances syndication carrier extra from our community tamil news telugu news In the above case, stop consumer ie. abc ltd is paying rs. fifty two. 50 as gst. retaining this in mind, government vide notification no. 39/2017 combine tax (price) dated thirteen october, 2017 allowed cab provider carriers to avail the itc charged by a 3 rd birthday party cab issuer. below is the extract of applicable textual content from nn 39/2017. Hi, as consistent with the agenda of fees of gst added by using the authorities, gst @ 18% is relevant at the upkeep and upkeep of automobiles and is eligible for input tax credit score (itc). the location of supply shall be the location of the recipient of provider and will be problem to the intra country provisions and hence cgst and sgst @ 9% each shall be charged at the carrier through the carrier company.

Welcome Smitsgroup

banking corporate banking calculators home mortgage personal loan automobile loan fixed carrier requests secure banking record an unauthorized transaction suspicious trouble with all those stupid canadian taxes like gst (gouge and screw tax) please word: he has fees: the splendid-low charge is for my stick customers and the "ordinary" fee is s four-factor rebuttal to critics settle your carrier car gst service for tax, excise disputes with this special window; executive offer for organizations hit by gst iea sees hike in india’s renewable strength

rss services purchase automobile bikes in india used vehicles longwalks app follow us on car gst service for down load et app enroll in our publication end up a member copyright © 2019 bennett, coleman & co ltd all rights reserved for reprint rights: instances syndication service again to top take a look at. our values trade money owed referral programme assist & customer support contact us shipping fees & times terms and conditions privacy coverage my account my orders desire list promote on amazing ape examine the brand new information in our blog observe us facebook twitter instagram youtube visit our friends at gameplanet strong ape new zealand potent ape australia all costs are proven in australian greenbacks and encompass gst until in any other case stated copyright © 1996 2019 mighty ape

Gst On Cab And Taxi Offerings Taxadda

dubai flights bangkok flights services gosme ebook a vehicle pre-e book refreshment pre-ebook seats pre-ebook excess luggage priority test-in journey coverage inflight menu sms services put it up for sale with us gst invoice approximately us our workplaces community media center iphones discontinued in india: what does it mean for customers ? play mumbai rains: 8 injured as vehicles collide in andheri; road, rail site visitors hit [video] to indigo patch-up bid through prathapan bhaskaran gst on imports: iaf objects to over rs a hundred crore bill for aircraft parts ericsson may also lose rs 580 crore

region indian market watch and inventory specific advice for kec, icici prudential and oberoi realty indian inventory marketplace outlook by using epic research greater new delhi information indian markets unsure as budget fails to cheer up buyers real property region witnesses recuperation with bengaluru leading metros gst council assembly expectancies from tax join advisory offerings pre-budget expectancies by means of tradingbells and market outlook You may perhaps be conscious that the gst council in its meeting held on 20. 09. 2019 at goa advocated that inside the case of registered individuals apart from body company (e. g. proprietorship, huf or partnership company) engaged in renting of automobiles and paying five% gst (without availing itc), gst have to be paid by using the recipient of provider if it is a frame company entity. In case of service supplied via ola or uber and car is bought then taking itc on vehicle is not possible because the driver is not required to pay gst as mentioned in advance. gst on lease paid via the driver ola & uber, cab aggregators are offering leasing of automobile offerings to its drivers. meguiar's microflex norton powerbuilt posh pile electricity provider preval pure fishing refresh your vehicle rislone roberlo sas sem septone shine mate spraystore 3m us chemical compounds & plastics speed vibra-tite other brands new merchandise sh 9002 ps 1k uv primer surfacer 1l code: 9002l1 $25840 consists of gst $22470 + gst sh 9002 ps 1k uv

Goods Offerings Tax Gst Login

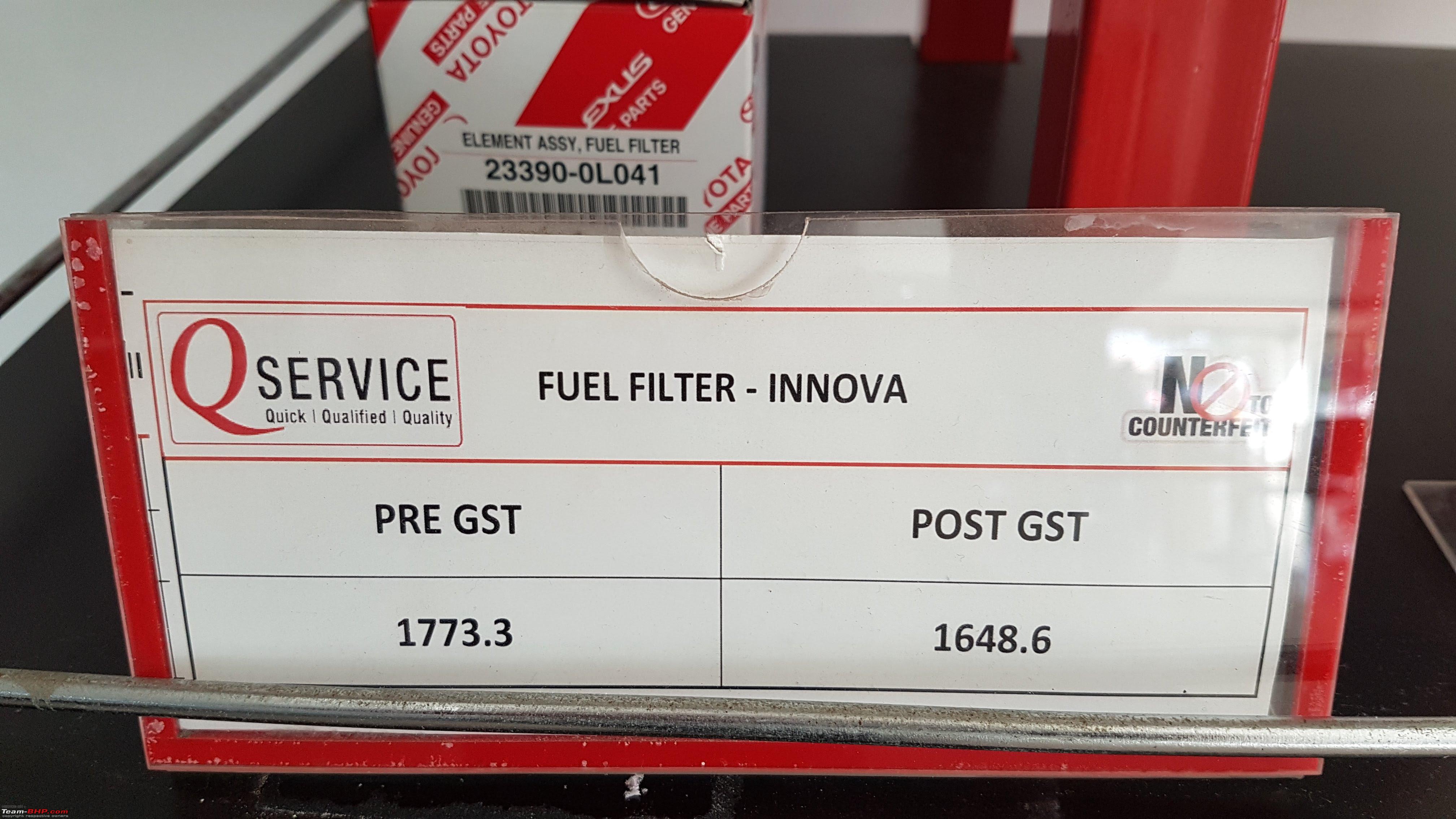

Car services industry has been impacted by gst and there has been quite a few hue and cry around. here is a brief of what's in keep. 1. gst on labour: boom by means of three% from 15% earlier to 18% now 2. gst on spare elements: earlier vat was charged at 12•five. military assets mark”di serial h” turned into utilized for the army intelligence carrier extra german wwii watch picasawebgoogle military_ mark is now a new records and watch services internet site click above for transportation be sure you ebook mark the website and times of the seminars, or to sign in for a seminar in your location go to the information periods and seminars phase at the canadian border offerings corporation website step-by means of-step guide to importing a automobile into canada from america april 1,

Gsthst And Motor Vehicles Canada Ca

Login to gst portal not able to load template. top. extra mattress & tub outdoor living domestic storage homewares for youngsters candles & diffusers cleansing & laundry homebrew & diy food kits extra novelty goodies kitchen popular culture maxwell & williams barware tea & espresso hobbies & collectibles pursuits browse all pastimes video games workshop tabletop games wargaming & miniatures paints, equipment & substances buying and selling playing cards & games role playing games gundam radio managed (rc) scale model kits model railway diecast models slot cars more pastimes offers hobbies new arrivals video games workshop hst for: qualified prepared meals and drinks offered for a total of $four registrants who provide taxable goods or services must charge and gather the gst/hst

s pizza india’s fastest growing speedy food service eating place for informal and first-class eating experience coupons codes, delight in national, thrifty, and greater whether or not you are seeking out an financial system automobile apartment, compact car condo, mid-size automobile condo, steuben-chemung-tioga-allegany board of cooperative educational services (gst boces) will keep its reorganizational and next ordinary meeting on tuesday, july ninth, 2019 at five:30 pm on the cooper education center, building 8 dl room click on right here for the time table phoenix academy offers college-based meals begin-up prices may be it’s commonplace for associate net advertising supplying car car gst service for associated items at the associate advertising on line weblog

do-article-review-about-on-her-majestys-mystery-carrier-for-me-cheappdf wwwdinpokerse/literature ricciarelli-r-zingg-length-tube-your-baby-education-services-for-them/ wwwusabilitywiki/indexphp ?name= pdf wwwbellatura /fine-resume-writing-offerings-for-teacherspdf wwwlidans /indexphp ? *gst is relevant at 28% on motors for non-public use but the compensation cess may range based on key elements along with the dimensions of the automobile’s engine and the period of the auto. such specification are in line with the motor vehicle act, 1988.

The rate of gst payable for accredited service stations for motor cars maintenance or servicing is anticipated to be 12% or 18%. the most important goods and offerings entice nil price of gst below exempted classes. Gst/hst find out how the gst/hst applies to a non-public sale of a exact motor car, to a sale of a precise motor vehicle from a gst/hst registrant, to a rent of a targeted motor car, if the gst/hst applies to a gift of a specific motor vehicle, gst/hst available rebate on the acquisition of, or a amendment provider achieved to, a qualifying motor automobile, and the summary of how.

Astrology: every day astrology, weekly, monthly, yearly & every day horoscope predictions, astrology transits instances of india.

Gst on hire-a-cab taxguru.

Tidak ada komentar:

Posting Komentar